Mutual Fund and FPI Activity – November 2025

Synopsis:

November 2025 recorded Mutual Fund SIP inflows of ₹29,445 crore, while FPIs posted net equity outflows of ₹3,765 crore. Sector-wise data indicates selling across IT, FMCG, consumer services and financials, alongside selective inflows into telecommunications, services and capital goods.

Source: Bajaj Broking Research Desk, AMFI, NSDL, Bloomberg

Mutual Fund SIP Trends

Monthly SIP Contribution – November 2025

Mutual Fund SIP contributions for November 2025 stood at ₹29,445 crore, reflecting steady use of SIPs as a mechanism for periodic investing.

Monthly SIP contribution trend between Nov 2024 and Nov 2025.

Source: AMFI / NSDL / Bloomberg

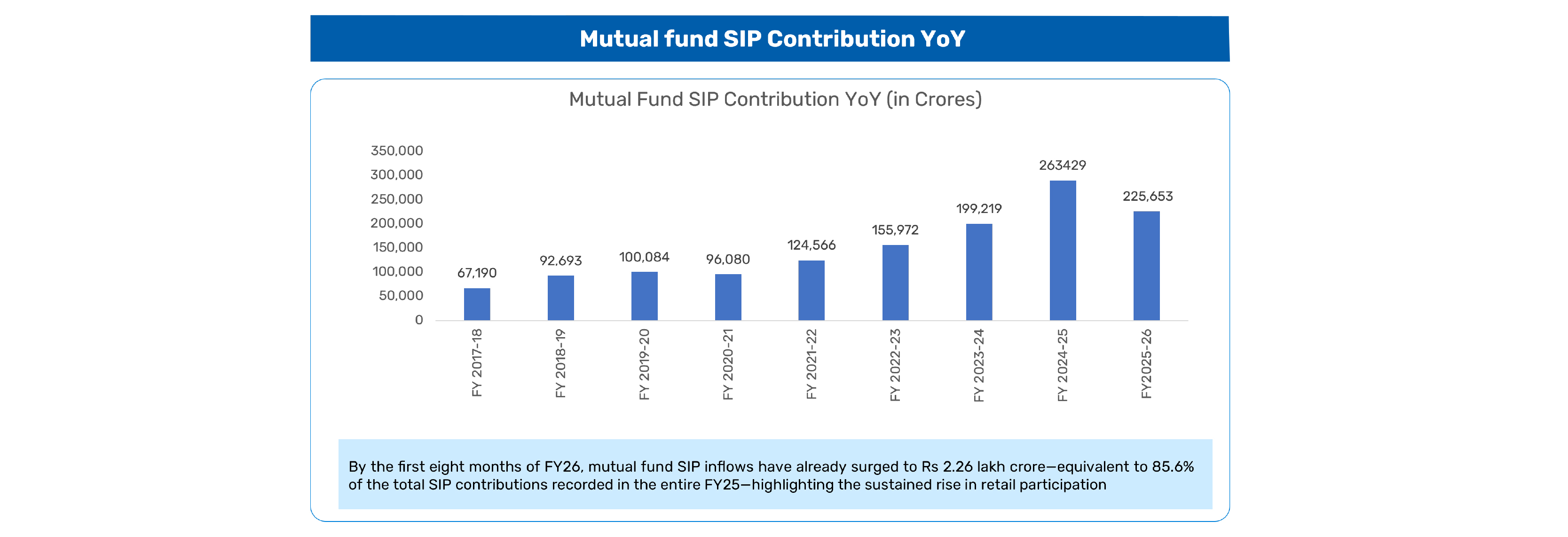

Year-on-Year SIP Contribution Trend

In the first eight months of FY26, SIP inflows totalled ₹2.26 lakh crore, representing 85.6% of the FY25 full-year SIP contribution. The data highlights consistent participation in SIPs across financial years.

Annual SIP contribution trend across financial years.

Source: AMFI / NSDL / Bloomberg

FPI Activity in Equity Markets

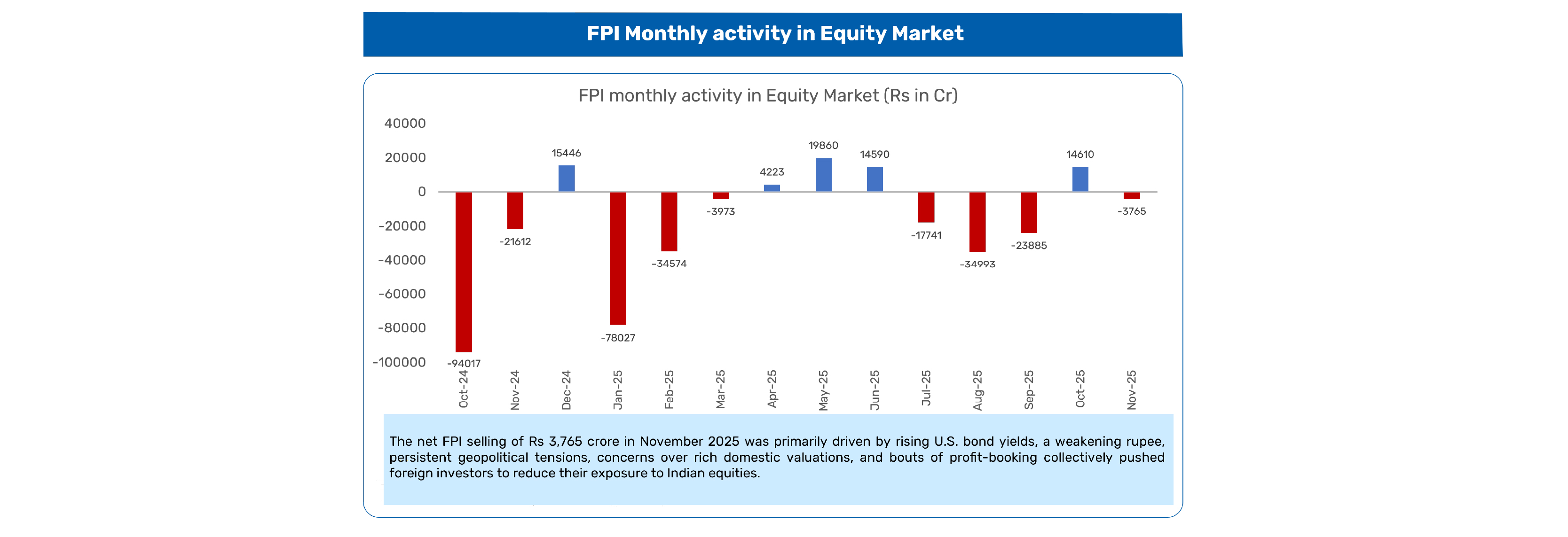

Monthly FPI Flows – November 2025

Foreign Portfolio Investors recorded net outflows of ₹3,765 crore in November 2025.

According to the report, factors influencing FPI activity included:

Higher U.S. bond yields

Rupee movement

Geopolitical developments

Valuation-related considerations

Profit-booking

FPI monthly activity in the equity market from Oct 2024 to Nov 2025.

Source: AMFI / NSDL / Bloomberg

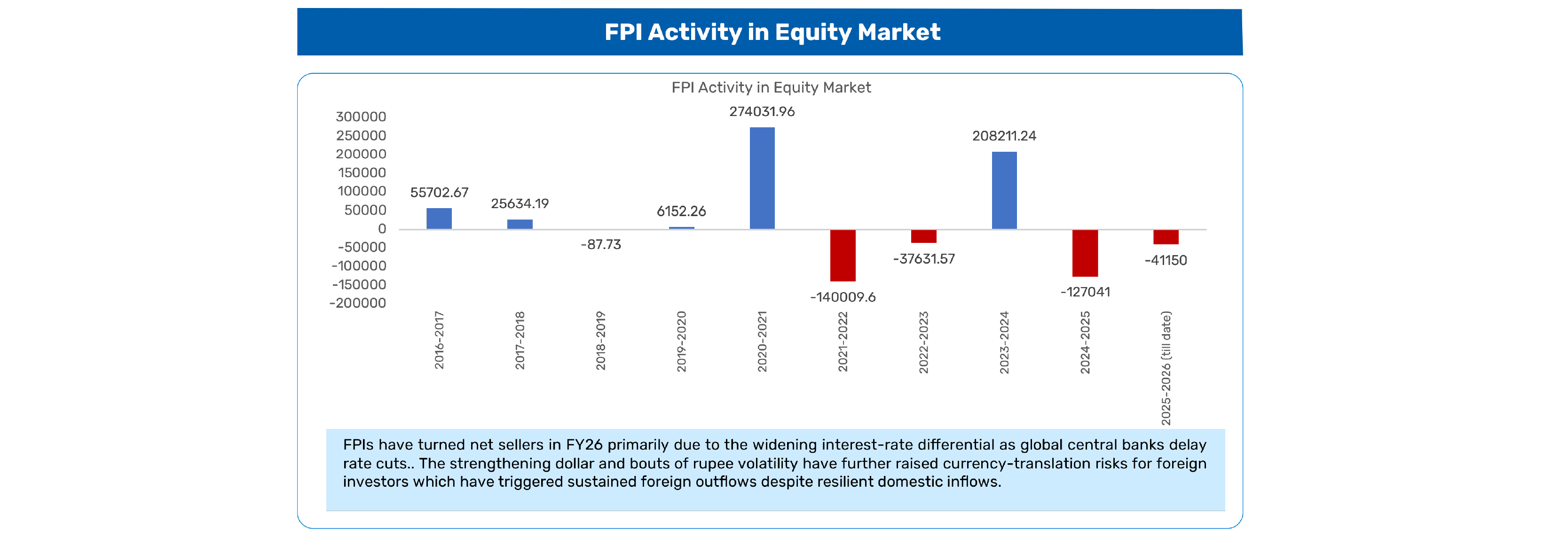

FPI Trend Across Financial Years (FY26 YTD)

The data shows FPIs as net sellers for most of FY26 to date. The report notes that factors such as wider interest-rate differentials, delayed global rate adjustments and currency volatility contributed to outflows during the period.

Financial-year-wise FPI activity, including FY26 to date.

Source: AMFI / NSDL / Bloomberg

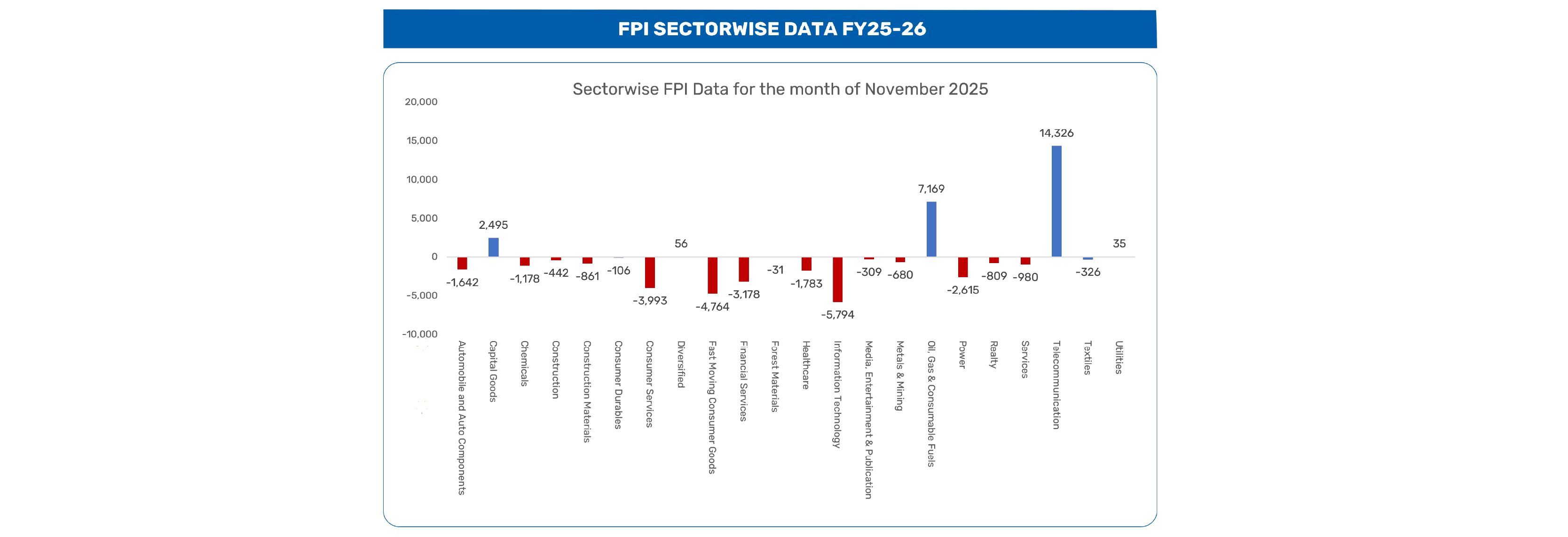

Sector-Wise FPI Flows – November 2025

Sectors with Net Outflows

The report shows broad outflows across several sectors in November 2025. Major outflows were recorded in:

Information Technology: ₹–5,794 crore

Fast-Moving Consumer Goods: ₹–4,764 crore

Consumer Services: ₹–3,993 crore

Financial Services: ₹–3,178 crore

Healthcare: ₹–1,783 crore

Automobile & Auto Components: ₹–1,642 crore

Chemicals: ₹–1,178 crore

Construction Materials: ₹–861 crore

These outflows indicate reduced exposure across multiple consumption-linked and cyclical sectors based on the month’s reported data.

Selective inflows for the month were concentrated in the following areas:

Telecommunication: ₹14,326 crore

Oil & Gas / Energy: ₹7,169 crore

Capital Goods: ₹2,495 crore

The report notes that these sectors benefited from themes such as telecom profitability, services demand, and capital-expenditure-linked activity.

Sector-wise FPI inflows and outflows for November 2025.

Source: AMFI / NSDL / Bloomberg

Conclusion

November 2025 reflects a month of steady domestic inflows through SIPs alongside selective positioning by FPIs. While SIP contributions remained consistent. FPIs reduced exposure across several sectors and increased allocations in telecommunications, services and capital goods. The data captures a mix of persistent retail participation and cautious foreign investment behaviour during the period.

Disclaimer :

Investments in the securities market are subject to market risk, read all related documents carefully before investing. This content is for educational purposes only. Securities quoted are exemplary and not recommendatory.

The information on this website is provided on "AS IS" basis. Bajaj Broking (BFSL) does not warrant the accuracy of the information given herein, either expressly or impliedly, for any particular purpose and expressly disclaims any warranties of merchantability or suitability for any particular purpose. While BFSL strives to ensure accuracy, it does not guarantee the completeness, reliability, or timeliness of the information. Users are advised to independently verify details and stay updated with any changes.

The information provided on this website is for general informational purposes only and is subject to change without prior notice. BFSL shall not be responsible for any consequences arising from reliance on the information provided herein and shall not be held responsible for all or any actions that may subsequently result in any loss, damage and or liability. Interest rates, fees, and charges etc., are revised from time to time, for the latest details please refer to our Pricing page.

Neither the information, nor any opinion contained in this website constitutes a solicitation or offer by BFSL or its affiliates to buy or sell any securities, futures, options or other financial instruments or provide any investment advice or service.

BFSL is acting as distributor for non-broking products/ services such as IPO, Mutual Fund, Insurance, PMS, and NPS. These are not Exchange Traded Products. For more details on risk factors, terms and conditions please read the sales brochure carefully before investing.

Content Partner - Dalal Street Investment Journal Wealth Advisory Private Limited

This article is for educational purposes only and should not be considered investment advice. Market investments are subject to risks. DSIJ Wealth Advisory Private Limited is a SEBI-registered Research Analyst (Reg. No: INH000006396) and Investment Adviser (Reg. No: INA000001142). Please consult your financial adviser before investing.

For more disclaimer, check here : https://www.bajajbroking.in/disclaimer

Calculators

Read More Blogs

Our Secure Trading Platforms

Level up your stock market experience: Download the Bajaj Broking App for effortless investing and trading