New Year Stock Picks 2026 | Bajaj Broking Research Desk

Synopsis:

Bajaj Broking’s New Year Stock Picks 2026 outlines a research-driven portfolio spanning healthcare, banking, metals, and consumption. The report highlights clearly defined buying ranges, technical and fundamental triggers, and 12-month return opportunities based on earnings visibility, balance-sheet strength, and trend confirmation.

Source: Bajaj Broking Research Report

As markets enter 2026, investors are navigating a phase shaped by capacity expansion, margin normalisation, and selective sector leadership rather than broad-based rallies. Against this backdrop, the New Year Stock Picks 2026 by Bajaj Broking Research Desk brings together a focused set of opportunities across healthcare, banking, metals, and consumption, combining fundamental visibility with technical confirmation.

Max Healthcare Institute

Buying Range: ₹1,060–₹1,078

Target Price: ₹1,218

Upside: 13%

Time Period: 12 Months

Investment View

Max Healthcare’s investment opportunity is driven by an expansion cycle that is ROCE-accretive, sustained improvements in occupancy and ARPOB mix, and strengthening cash flows. The strategy prioritises brownfield expansion, asset-light growth, and operating leverage from newly acquired and greenfield units.

Cumulative project capex of approximately ₹6,487 crore is committed up to FY29, with a pipeline that more than doubles potential capacity over the medium term. The business is positioned to sustain high-teens revenue growth and deliver margin expansion as incremental beds scale. Network-level ROCE is above 28%, with existing units at approximately 38%, while net debt remains below 1x EBITDA

Valuation

Growth is supported by phased brownfield additions, greenfield hospitals, and asset-light facilities across metros and emerging clusters. Momentum is driven by the ramp-up of Dwarka, Noida, Lucknow, and Nagpur; ARPOB improvement from case-mix enrichment; and rising volumes in oncology and transplants. As assets mature and utilisation increases, the FY28 EBITDA base expands.

Applying a 28x EV/EBITDA multiple to FY28 earnings results in a target price of ₹1218.

Eternal

Buying Range: ₹285–₹292

Target: ₹323

Return Opportunity: 12%

Time Period: 12 Months

Technical Outlook

Eternal has been in a corrective phase for the past 2–3 months and is consolidating near the ₹280–₹270 demand zone. This zone aligns with:

● 80% retracement of the ₹257–₹368 up move,

● 52-week EMA near ₹278, and

● Bullish gap formed on 22 July 2025.

On the weekly chart, the stock spent 11 weeks correcting approximately 80% of the prior 11-week rally, reflecting time-led consolidation. A rebound toward ₹323 aligns with the 50% Fibonacci retracement of the fall from ₹368 to ₹280 and the November 2025 high.

The weekly stochastic has generated a buy signal.

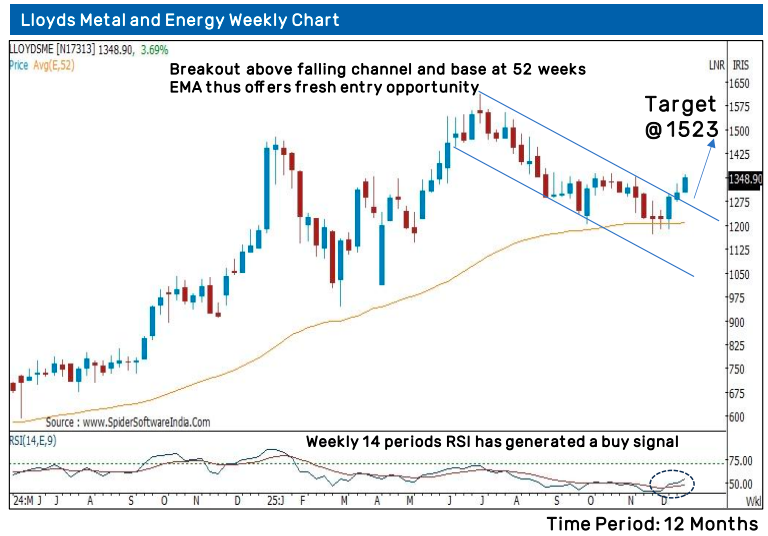

Lloyds Metals and Energy

Buying Range: ₹1,340–₹1,365

Target: ₹1,523

Return Opportunity: 13%

Time Period: 12 Months

Technical Outlook

Lloyds Metals and Energy has broken out above a falling channel that had contained prices for the past six months. The stock retraced its seven-week decline from ₹1,361 to ₹1,170 in three weeks.

The 52-month EMA, placed near ₹1,209, has acted as support over the past five years. The target of ₹1,523 corresponds to the 80% Fibonacci retracement of the broader decline from ₹1,612 to ₹1,170.

The weekly 14-period RSI has crossed above its 9-period average, generating a buy signal.

Kotak Mahindra Bank

Buying Range: ₹2,140–₹2,180

Target: ₹2,380

Return Opportunity: 10%

Time Period: 12 Months

Technical Outlook

Kotak Mahindra Bank has moved above its five-year consolidation range of ₹1,600–₹2,000. The ₹2,000 level is identified as a support zone.

The 52-month EMA, positioned in the ₹1,860–₹1,900 region, aligns with the rising long-term trendline. The monthly MACD remains above its nine-period average.

The measured move of the five-year range breakout indicates a move toward ₹2,400, with the stated target at ₹2,380.

Calculators

Read More Blogs

Disclaimer :

The information on this website is provided on "AS IS" basis. Bajaj Broking (BFSL) does not warrant the accuracy of the information given herein, either expressly or impliedly, for any particular purpose and expressly disclaims any warranties of merchantability or suitability for any particular purpose. While BFSL strives to ensure accuracy, it does not guarantee the completeness, reliability, or timeliness of the information. Users are advised to independently verify details and stay updated with any changes.

The information provided on this website is for general informational purposes only and is subject to change without prior notice. BFSL shall not be responsible for any consequences arising from reliance on the information provided herein and shall not be held responsible for all or any actions that may subsequently result in any loss, damage and or liability. Interest rates, fees, and charges etc., are revised from time to time, for the latest details please refer to our Pricing page.

Neither the information, nor any opinion contained in this website constitutes a solicitation or offer by BFSL or its affiliates to buy or sell any securities, futures, options or other financial instruments or provide any investment advice or service.

BFSL is acting as distributor for non-broking products/ services such as IPO, Mutual Fund, Insurance, PMS, and NPS. These are not Exchange Traded Products. For more details on risk factors, terms and conditions please read the sales brochure carefully before investing.

Investments in the securities market are subject to market risk, read all related documents carefully before investing. This content is for educational purposes only. Securities quoted are exemplary and not recommendatory.

For more disclaimer, check here : https://www.bajajbroking.in/disclaimer

Our Secure Trading Platforms

Level up your stock market experience: Download the Bajaj Broking App for effortless investing and trading